MAP Marketplace / ACA

Commercial Payers struggle to find avenues to profitability in the ACA’s complex risk adjustment program. As premiums continue to shrink, it is now a need of the hour for the health plans to accurately report their RAF scores. Since the RA program is a zero-sum game therefore some of the insurers are stuck paying massive sums to their competitors. Majority of the health plans rely on a vendor solution for claims-processing and most of the time they are not able to get the data in time to report to CMS.

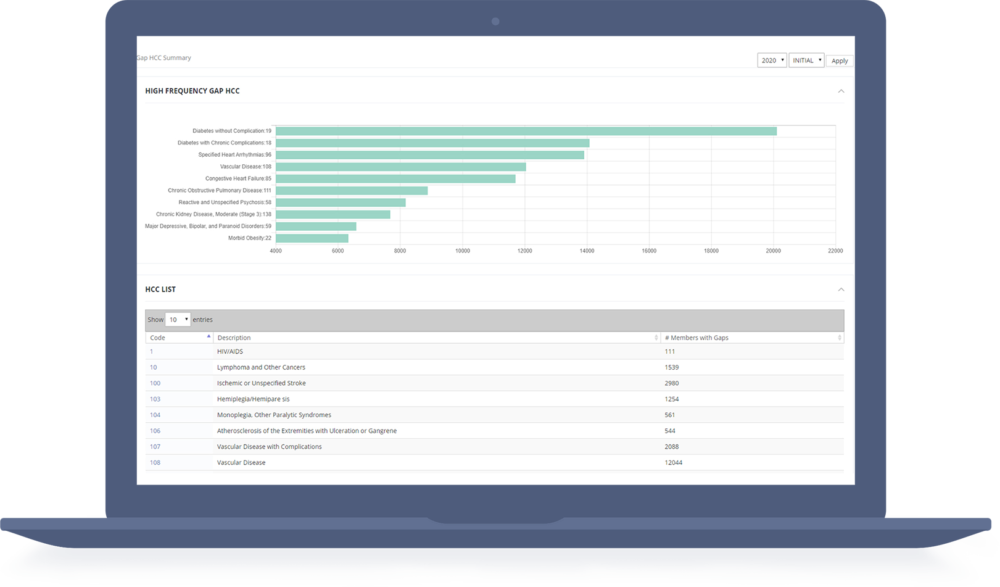

Insurers/ Health Plans need a solution or a product that collects all medical, prescription, claims information in real-time or near real-time mode and analyze that data to find gaps in Risk scores and have a process to fix them quickly. Unlike Medicare, health plans have very short time window to ensure that all supplemental diagnosis codes are reported on time and to ensure appropriate HCC conditions are captured and reported to CMS Edge Server.

Manage Risk Adjustment for Marketplace/ACA Effectively

Invent Health’s MAP extends beyond just claims data analytics, it also incorporates alternate data sources such as pharmacy and care management data to identify comprehensive risk gaps. We harness healthcare data to provide impact analysis and risk score gap closure workflow solutions designed specifically for ACA market.

Our risk adjustment team provides analytics support and deep risk adjustment expertise to interpret your risk score data, trending of utilization, and closure of gaps. With the help of various products and services, our team will help health plans and providers to be successful in managing the risk score payment models.

Key Features of MAP Marketplace/ACA

The keys features of the product are designed to assist across the ACA programs:

MAP has Predictive models to chase and drive wellness programs to improve quality while aiding in the correct charting of conditions.

MAP’s Utilization Analytics module drives and targets high risk populations to drive wellness programs.

MAP has API’s to integrate with encounter submission process to prioritize high risk claims for submission.

provide real-time or near-time access to the data to find ways to recommend behavior for submissions, provider coding errors, supplemental data submissions.

Unique, customizable client reports specific by Issuer, Plan level, provider level.

Manage Risk Adjustment for Marketplace/ACA Effectively

MAP Marketplace Supports various data inputs and helps in performing the analysis.

- Ability to ingest 837, CSV , XML or custom input of claims, pharmacy, clinical data

- Loads Edge Server RARSS And RARDS reports to reconcile and find discrepancies.